Student Loans

Student loans are a necessity for many people who are trying to go to college or university, or in some cases, trade schools. Over forty-three million Americans have student loans at this time, this has been increasing by about a million borrowers per year since 2007. Not many people can save the money for college anymore, making it a necessity for them. The average student loan is around thirty thousand dollars per year, making a four-year college around one hundred-twenty thousand dollars.

Many people say that their number one priority is getting these loans paid off in the new year, but with these amounts, it is difficult to do. These people often want to refinance their student loans to get better rates and lower payment amounts, but that just makes it take longer to pay them off. If you are looking to refinance or just to get your first student loans, keep reading for more information. There are many private lenders that will be happy to help you to get the loan that you are seeking.

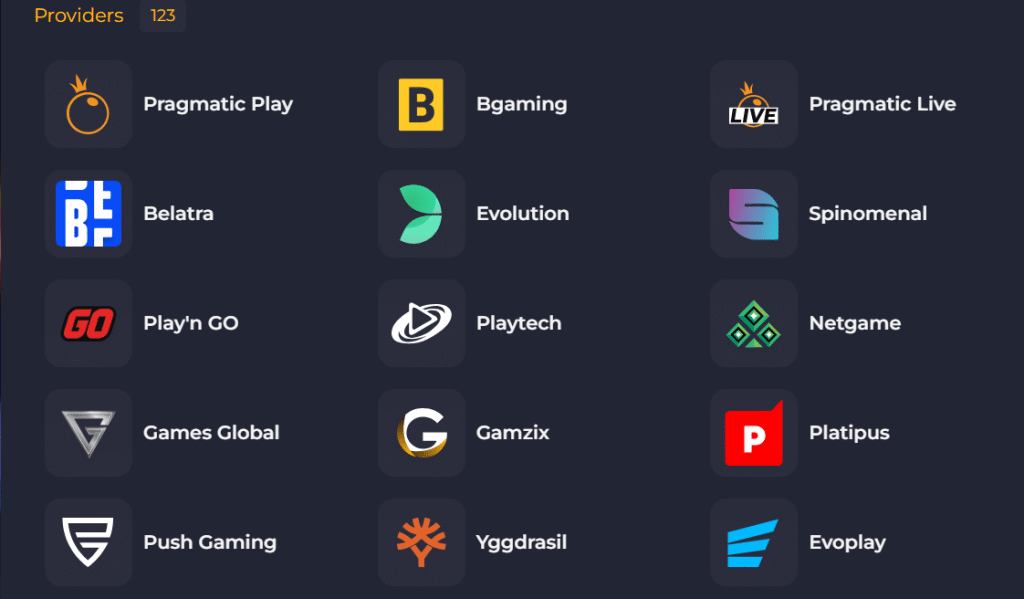

You can do an internet search to get you started on your search for a student loan. You could go to www.billigeforbrukslån.no/privatlån/to see what they have to offer you. They have several possibilities that you could check out so that you find the one that is best for you.

This article will give you some information about student loans, and just loans in general. It will help you to learn more about these important loans that are necessary for your college career. You can also do more research to find the information that you need.

Information You May Need

1. Organize – This is important, especially if you have more than one student loan from multiple providers. You want to organize by provider, date due, and required minimum payment so that you know when your bills are due and which ones need to be paid first. If you can’t remember who you owe, there is a database that can help you to figure this out. You can go to the National Student Loan Database to see which lenders you owe money to.

If you have private student loans, you can get a free annual credit report from any of the three main credit bureaus. This will have all the loans that you have taken out for college, university, or trade schools. You can make a list of everything you owe by getting this report and then you can organize them as was mentioned above.

2. Federal Alternative Repayment Options – If you have made the list above of all that you need to repay and have discovered that there is too much for you to be able to pay at once, there are options for you. If your loans were federally guaranteed, you have more options than if they were given to you by private lenders. You can get an income driven repayment plan that will help you to pay them back on your terms.

If you qualify for these repayment terms, you could pay as little as ten percent of your discretionary income. You could also stretch the repayment terms to as long as twenty-five years to make payments even easier for you. This should make the repayment of all your loans easier for you because you could have payments of less than one hundred dollars per month.

3. Private Lender Relief – You could also get relief from private lenders if you call them before you are late on your payments. They can lower your interest rates or lower your payment amounts for a little while until you get on your feet. They can even suspend them for a while if you can’t make any payments at all. You just need to call them to make arrangements – most lenders will be happy to work with you.

The bigger, more well-known lenders will be more likely to be able to help you. If you go to a small, independent lender, they may not be able to help you as easily. This is because they don’t have the available capital to be able to help as much as the bigger lenders. They may still be able to help you a little, so make sure you call them to see what they can do.

4. Refinance if You Can – If you have good credit and have made all your payments on time until now, you can probably refinance your student loans. There are many newer lenders that have entered the student loan market, and they will be able to refinance for you. You need to have very good credit to qualify for most of these, so keep your credit report as clean as you can by making all your payments on time.

If you are lucky and have the credit that you need, you could save a lot by refinancing. You could save as much as fourteen thousand dollars over the length of your loan by going to the right lender. This is a lot of money that could be used for paying off other loans and bills that you might have.

5. Avoid Scams – Be wary of deals that seem too good to be true – if they sound that way, it is because they are most likely scams. There are sketchy lenders out there that are trying to get your business and then trick you into paying more. They usually want hefty upfront fees that you can barely afford in exchange for student loan forgiveness. You are then left with your original payments, and you are out the upfront fees that you were charged.

These unscrupulous lenders often have websites that look like the actual federal websites, but they are off by a letter or space. They lead you to a website that can fool you into thinking that you are working with legitimate lenders. Be careful when you are searching and make sure that you have the right websites before you sign any paperwork.

6. Use Autopay – To make things easier for you, set up autopay for any lender that will allow you to do this. This way you can make sure that your bills are paid on time, and you don’t have to worry about them. You just need to make sure that you have money in your account when the money is due to be taken out.

Some lenders will also offer you a discount if you are making autopayments because they know they are getting their money each month. These discounts can be as much as .25% of your interest rates. If you are on an extremely tight budget and might not have the money in your account, this is probably not a good idea for you.

7. Fixed Rate Versus Variable Rate – A fixed rate is exactly what it sounds like – a rate that stays the same throughout the time of your loan. It won’t change even if the Federal Rates have risen because you agreed to that when you signed your papers. This is probably the best rate for most people even though it might be a slightly higher rate to begin with.

A variable rate will change when the Federal Rates change and can become higher or lower depending on what the government decides. Unfortunately, these usually go up in price and rarely come down. People opt for these rates in the hopes that they will get lower over time.

8. Try Scholarships – If you are still in school, you can try to get scholarships to help you pay for your college education. They are just for incoming freshmen; you can get a scholarship even if you are a senior and getting ready to graduate. There are different websites that you can search for that show you the different scholarships that you may qualify for.

These websites are easy to find, you just need to do an internet search for them. Some that you can look at are Cappex.com, Fastweb.com, and Scholarships.com. These are just a few that you can try – there are so many more when you do a quick search.

9. Award Letters – You need to make sure that you completely understand the award letters that you get when you are promised financial aid. Some of this aid is in the form of grants that don’t have to be paid back, and loans that do need to be paid back. Make sure that you read the fine print to see how much each is.

Colleges do this to make your financial aid numbers look better to you. They have mixed the numbers and added them up so that you have all the aid that you need, but you must know how much of this is in loan form. You don’t want to be surprised later when you start getting bills.

10. Debt Doesn’t Make Your Life Over – Just because you have debt it doesn’t mean your life is over. You just need to make sure that you find a way to pay it back. You don’t have to sell an organ to pay it back, you could get a second job or ask family and friends for help when you need. There are always options to get your debt paid off.

Conclusion

There are many things that you need to know about student loans. If you learn about these things, you will feel better about them. You don’t need to worry about having student loan debt if you can make your payments on time. If you can’t make your payments on time, there are still options for you.