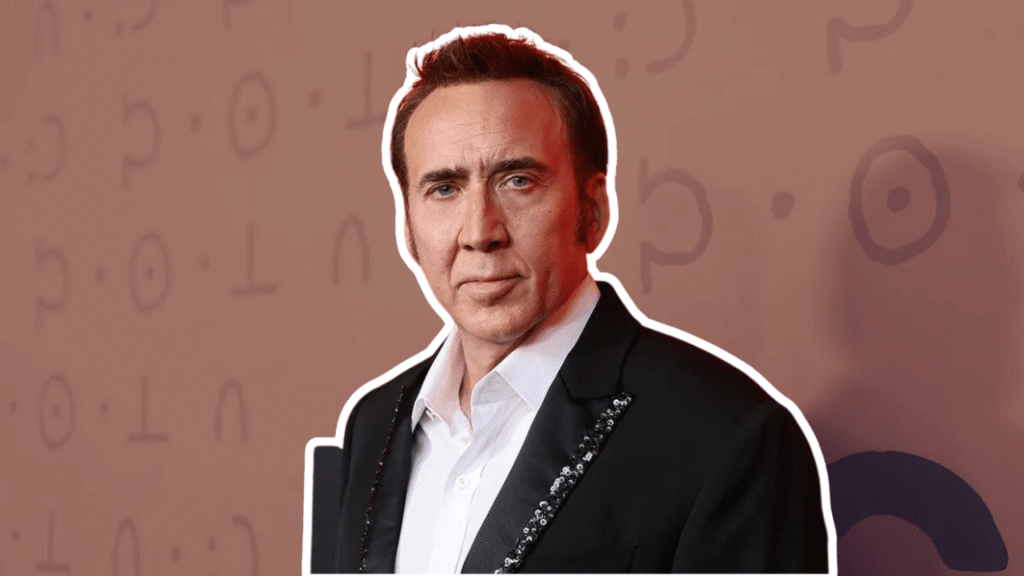

Nicolas Cage, synonymous with blockbuster hits and eccentric performances, once stood at the pinnacle of Hollywood success.

Cage’s earnings were nothing short of astronomical at the height of his career.

Reports suggest the actor pocketed a staggering $150 million between 1996 and 2011, a testament to his box office draw and the golden era of his cinematic reign.

His financial success seemed as larger-than-life as the characters he portrayed on screen.

However, a storm was brewing in Cage’s financial world beneath the glitz and glamour of red-carpet premieres and adoring fans.

Join us as we see how a combination of extravagant living and risky investments transformed a Hollywood success story into a stark reminder of the fragility of wealth and the importance of financial prudence.

The Rise: Nicolas Cage’s Hollywood Success and Wealth Accumulation

Before we dive into the financial turmoil that would define much of Nicolas Cage’s later career.

It’s essential to understand the meteoric rise that preceded his fall.

Cage’s journey to Hollywood stardom is a tale of talent, opportunity, and success most actors only dream of achieving.

1. Early Career Breakthroughs

Nicolas Cage’s path to stardom began in the early 1980s:

- Family connections: Born into the famous Coppola family, Cage (born Nicolas Kim Coppola) initially sought to make his name in the industry.

- Breakthrough role: His performance in “Valley Girl” (1983) marked him as a rising star to watch.

- Critical acclaim: His roles in films like “Birdy” (1984) and “Peggy Sue Got Married” (1986) showcased his versatility and earned him critical praise.

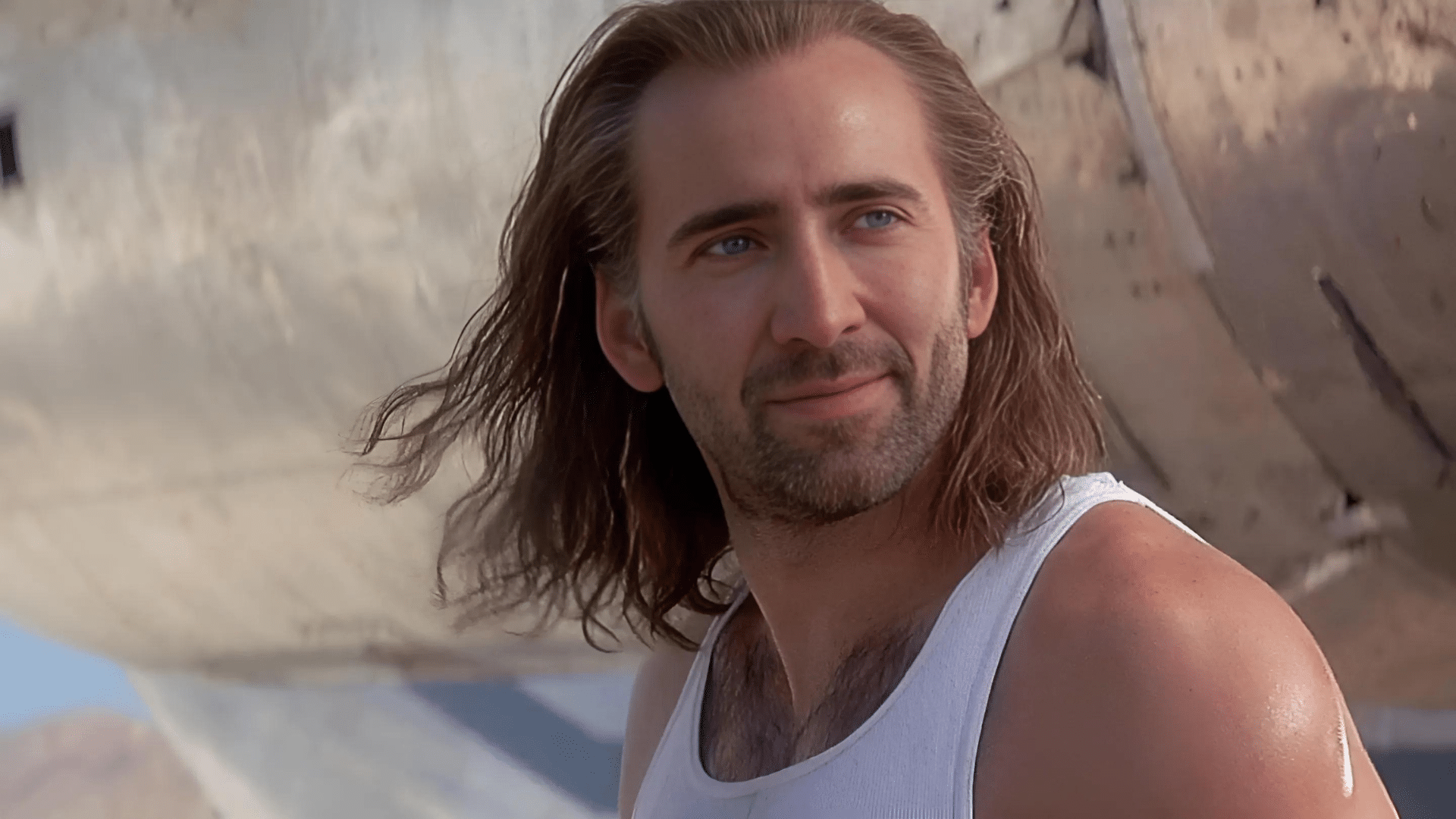

2. Box Office Domination

The 1990s and early 2000s saw Cage transform from a respected actor into a bona fide Hollywood powerhouse:

- Action hero status: Films like “The Rock” (1996), “Con Air” (1997), and “Face/Off” (1997) established Cage as a bankable action star.

- Oscar glory: His powerful performance in “Leaving Las Vegas” (1995) earned him an Academy Award for Best Actor.

- Blockbuster hits: “National Treasure” (2004) and its sequel further cemented his status as a box office draw.

3. Peak Earnings

Cage’s success translated into enormous paychecks:

- $20 million per film: Cage commanded this staggering sum for starring roles at his peak.

- Cumulative earnings: Between 1996 and 2011, Cage reportedly earned over $150 million from his film roles.

- Highest-paid actor: For several years, Cage ranked among the top-earning actors in Hollywood.

4. The Lifestyles of the Rich and Famous

With great wealth came the trappings of an extravagant lifestyle:

- Luxury real estate: Cage began accumulating a portfolio of high-end properties around the world.

- Exotic purchases: From rare cars to private islands, Cage’s spending habits became the stuff of Hollywood legend.

- Collectibles and curiosities: The actor developed a reputation for acquiring unusual and expensive items.

Nicolas Cage’s rise to the top of Hollywood was nothing short of spectacular.

His unique acting style and a string of box office successes had transformed him from a quirky character actor into one of the industry’s most bankable stars.

With a net worth estimated at over $150 million at his peak, Cage seemed to have it all – critical acclaim, commercial success, and the financial means to indulge in his every whim.

However, as we’ll soon discover, the dizzying heights of success can sometimes lead to choices that have far-reaching and unexpected consequences.

Cage’s journey from this pinnacle of wealth and fame to financial turmoil is a stark reminder of the volatile nature of Hollywood fortunes and the pitfalls of unchecked spending.

Nicolas Cage’s Extravagant Spending Habits

Nicolas Cage’s star power grew, as did his appetite for the extraordinary and the expensive.

The actor’s spending habits became almost as legendary as his on-screen performances, painting a picture of a man determined to live life as large as the characters he portrayed.

1. Luxury Real Estate

Cage’s property portfolio reads like a “who’s who” of desirable global addresses:

- Multiple mansions: At one point, Cage owned up to 15 residences simultaneously, including properties in Las Vegas, New Orleans, and Rhode Island.

- International holdings: His global acquisitions included a castle in Germany, a private island in the Bahamas, and a manor house in England.

- Historical significance: Many of Cage’s properties were chosen for their unique history or architectural importance.

2. Exotic Transportation

The actor’s taste for the unusual extended to his modes of transport:

- Luxury cars: His collection included rare and vintage automobiles, such as a $450,000 Lamborghini and a $550,000 Ferrari Enzo.

- Yachts: Cage owned multiple luxury yachts, including a 40-meter vessel worth millions.

- Private jets: For a time, Cage traveled in his Gulfstream jet, symbolizing his Hollywood success.

3. Rare Collectibles and Curiosities

Cage’s spending often veered into the realm of the bizarre and extraordinary:

- Comic books: A famous comic book collector, Cage once owned a near-mint copy of Action Comics #1 (the first appearance of Superman), which he later sold for over $2 million.

- Prehistoric remains: The actor purchased a 67-million-year-old Tarbosaurus skull for $276,000, which he later had to return due to its illegal provenance.

- Exotic animals: Cage’s menagerie included rare albino king cobras and an octopus, which he claimed helped his acting.

4. Eccentric Purchases

Some of Cage’s acquisitions were as unique as his film choices:

- Shrunken pygmy heads: Reportedly part of his collection of unusual artifacts.

- Haunted mansion: The infamously haunted LaLaurie Mansion in New Orleans became part of his real estate portfolio.

- Pyramid tomb: Cage had a 9-foot tall pyramid-shaped tomb constructed in a New Orleans cemetery, intended as his future resting place.

5. Luxury Lifestyle Expenses

Beyond tangible purchases, Cage’s lifestyle itself was a source of significant expenditure:

- Staff and entourage: A full-time staff to manage his properties and affairs.

- Lavish parties: Known for hosting extravagant events and celebrations.

- Fine dining and travel: Regular indulgences in gourmet cuisine and first-class global travel.

Nicolas Cage’s spending habits were more than just the typical excesses of a Hollywood star.

They reflected a man with an insatiable curiosity for the unique and the valuable, seemingly unburdened by financial constraints.

His purchases often blurred the line between investment, collection, and impulse, creating a portfolio as diverse and enigmatic as his film roles.

However, this unrestrained approach to spending would soon collide with financial realities, setting the stage for a dramatic reversal of fortune.

The Real Estate Frenzy: A Portfolio of Luxury Properties

At the heart of Nicolas Cage’s financial saga lies his ambitious and ultimately ill-fated foray into the world of luxury real estate.

Cage’s property portfolio wasn’t just about finding places to live; it reflected his larger-than-life persona and passion for the unique and historical.

Let’s explore some of the most notable properties that define Cage’s real estate empire.

1. LaLaurie Mansion, New Orleans

Perhaps the most infamous of Cage’s properties:

- Historical significance: Known as one of the most haunted houses in America, with a dark history dating back to the 1830s.

- Purchase details: Cage acquired the property in 2007 for a reported $3.45 million.

- Unique appeal: The mansion’s macabre history aligned with Cage’s interest in the supernatural and eccentric.

2. Middletown Mansion, Rhode Island

A prime example of Cage’s taste for grandiose estates:

- Size and scope: This sprawling 24,000-square-foot estate sat on 26 acres.

- Historical value: Built in 1885, the mansion was known for its exquisite craftsmanship and period details.

- Luxury amenities: The property boasted 12 bedrooms, expansive gardens, and a private beach.

3. Bel Air Mansion, Los Angeles

A symbol of Hollywood excess:

- Celebrity pedigree: Previously owned by Tom Jones and Dean Martin.

- Opulent features: The mansion included a wine cellar, home theater, and Olympic-sized pool.

- Financial woes: Cage sold this property at a significant loss, foreshadowing his coming financial troubles.

4. Schloss Neidstein, Bavaria, Germany

Cage’s most regal acquisition:

- Historical importance: An 11th-century castle with a rich history.

- Renovation plans: Cage had ambitious plans to restore the castle to its former glory.

- Short-lived ownership: Financial pressures forced Cage to sell the property after just two years.

5. Other Notable Properties

Cage’s real estate portfolio extended far beyond these headline-grabbing properties:

- Private islands: Including an island in the Bahamas, showcasing his taste for exclusivity.

- Multiple residences: Homes in Las Vegas, San Francisco, and New York, among others.

- International properties: A manor house in Somerset, England, adding to his global real estate footprint.

6. The Appeal and Risks of Cage’s Real Estate Investments

Cage’s approach to real estate was characterized by:

- Passion for history: Many of his properties were chosen for their historical significance or unique stories.

- Renovation ambitions: Cage often had grand plans for restoring and improving his properties.

- High maintenance costs: The upkeep of these extensive and often old properties was enormously expensive.

- Market volatility: Many of these high-end properties were particularly vulnerable to market fluctuations.

Nicolas Cage’s real estate portfolio was more than just a collection of homes; it reflected his larger-than-life personality and passion for the extraordinary.

Each property seemed to tell a story, much like the characters Cage portrayed on screen.

However, this expansive and eclectic collection of real estate would soon become a significant factor in his financial downfall.

The maintenance costs, property taxes, and market volatility associated with such an extensive portfolio of unique properties created a perfect storm of financial pressure.

As we’ll explore in the next section, these lavish investments, combined with other factors, would lead Cage down a path of economic ruin that even his Hollywood earning power couldn’t prevent.

The Financial Crash: What Went Wrong?

The unraveling of Nicolas Cage’s vast fortune is a cautionary tale of how even the mightiest can fall when financial prudence takes a backseat to extravagance and risky investments. The actor’s journey from Hollywood’s A-list to the brink of bankruptcy was as dramatic as any role he ever played on screen.

1. Mismanagement of Wealth

At the heart of Cage’s financial troubles was a fundamental mismanagement of his substantial earnings:

- Lack of diversification: Cage’s wealth was heavily tied up in real estate, a notoriously illiquid asset class.

- Absence of financial planning: There seemed to be little long-term strategy to sustain his lavish lifestyle.

- Overreliance on future earnings: Cage appeared to spend based on expected future income rather than current assets.

2. The Real Estate Market Crash

The 2008 financial crisis hit Cage’s property investments particularly hard:

- Plummeting property values: Many of Cage’s high-end properties lost significant value almost overnight.

- Inability to sell: The luxury real estate market froze, making it nearly impossible to offload properties quickly.

- Negative equity: Some properties were worth less than their mortgages, trapping Cage in a financial dilemma.

3. Mounting Debts and Expenses

As his income struggled to keep pace with his lifestyle, Cage found himself drowning in debt:

- Mortgage payments: The costs of maintaining multiple high-value properties became unsustainable.

- Maintenance and staffing: The upkeep of his extensive real estate portfolio and lifestyle required significant ongoing expenses.

- Accumulated interest: As debts mounted, interest payments began to snowball, creating a vicious financial cycle.

4. Tax Troubles with the IRS

Perhaps the most significant blow to Cage’s finances came from an unexpected quarter – the Internal Revenue Service:

- Unpaid taxes: In 2009, the IRS filed a federal tax lien against Cage for over $6.2 million in unpaid taxes.

- Additional liens: Further tax liens were filed in subsequent years, totaling millions more.

- Penalties and interest: The mounting tax debt was exacerbated by penalties and interest charges.

5. Legal Battles and Lawsuits

A series of legal challenges compounded Cage’s financial woes:

- The lawsuit from ex-business manager: Cage’s former business manager sued him for unpaid fees, while Cage countersued for negligence.

- Property disputes: Legal battles erupted over some of his real estate transactions and unpaid debts.

- Contractual obligations: Cage was embroiled in disputes over various business deals and investments.

6. The Perfect Storm

The combination of these factors created a perfect storm of financial disaster:

- Cash flow crisis: While Cage’s income is still substantial, it cannot keep up with his mounting debts and obligations.

- Asset liquidation pressure: The need to quickly sell assets to cover debts often resulted in significant losses.

- Reputational damage: As news of his financial troubles spread, it began to impact his marketability in Hollywood.

Nicolas Cage’s financial downfall was not the result of a single poor decision but rather a culmination of years of unchecked spending, risky investments, and a lack of sound financial planning.

External factors like the real estate market crash and his tax troubles exacerbated the actor’s situation, creating a financial crisis that seemed almost insurmountable.

As we’ll explore in the next section, the consequences of this financial meltdown would be severe, leading to foreclosures, forced sales, and a dramatic shift in Cage’s career and lifestyle.

His story is a stark reminder that even the highest of Hollywood earners are not immune to the basic principles of financial management and the unpredictable nature of the market.

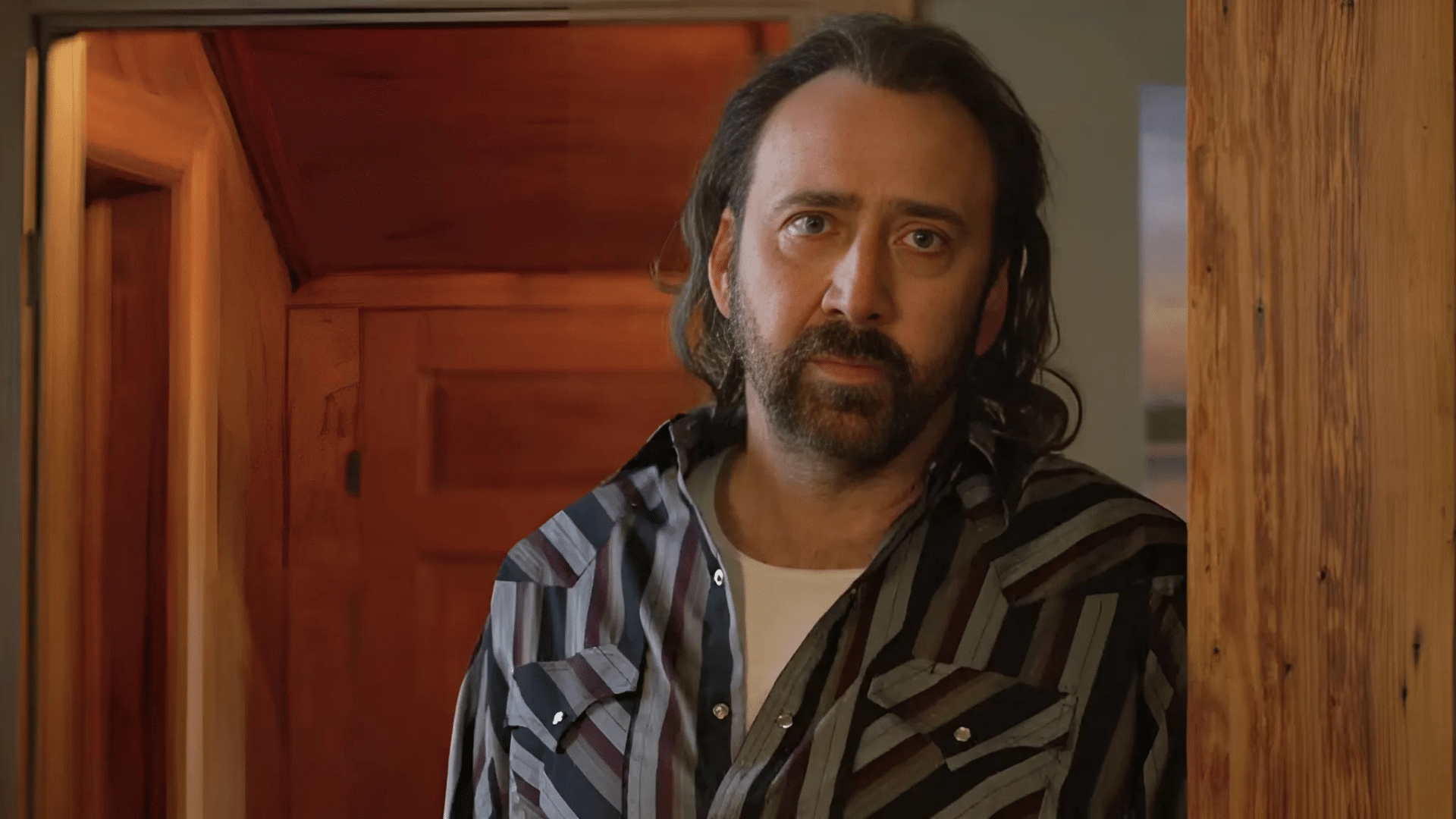

Efforts to Rebuild: Cage’s Financial Rehabilitation

In the aftermath of his financial crisis, Nicolas Cage faced the daunting task of rebuilding his career and stabilizing his finances.

He required a dramatic shift in his professional approach and personal lifestyle during this rehabilitation period.

1. Career Resurgence

Cage adopted a new strategy to revitalize his acting career:

- Increased workload: The actor began taking on more roles, sometimes appearing in multiple films per year.

- Diverse projects: Cage showed a willingness to work on various projects, from big-budget films to independent productions.

- Voice acting: He expanded into voice work for animated films, adding another revenue stream.

2. Shifting Focus

Cage’s approach to selecting roles evolved:

- Quality over paycheck: While still taking some high-paying roles, Cage began to focus more on challenging, critically-acclaimed parts.

- Indie renaissance: His appearances in independent films like “Joe” (2013) and “Mandy” (2018) earned him renewed critical respect.

- Embracing his image: Cage leaned into his reputation for eccentric performances, turning it into a marketable asset.

3. Lifestyle Downsizing

To align with his new financial reality, Cage made significant changes to his personal life:

- Modest living: Moving from mansions to more reasonably-sized homes.

- Asset liquidation: Selling off many of his remaining luxury items and collectibles.

- Reduced entourage: Cutting back on personal staff and extravagant expenses.

4. Debt Repayment Strategy

Addressing his substantial debts became a priority:

- IRS negotiations: Working out payment plans with the IRS to settle his tax debts.

- Prioritizing creditors: Strategically addressing his most pressing debts first.

- Income allocation: Designating a significant portion of his earnings towards debt repayment.

5. Legal Resolutions

Cage worked to resolve ongoing legal issues:

- Settling lawsuits: Reaching agreements in various legal disputes to minimize further financial drain.

- Avoiding future litigation: Being more cautious in business dealings to prevent new legal entanglements.

6. Financial Management Overhaul

Learning from past mistakes, Cage revamped his approach to financial management:

- New advisors: Bringing in reputable financial advisors and accountants.

- Budgeting: Implementing stricter budgeting and financial planning practices.

- Investment caution: Taking a more conservative investment approach avoids high-risk ventures.

7. Rebuilding His Brand

Cage worked on rehabilitating his public image:

- Selective interviews: Carefully choosing media appearances to discuss his career rather than his financial troubles.

- Self-awareness: Displaying a sense of humor about his past excesses and current situation.

- Fan engagement: Reconnecting with his fan base through more personable public appearances and social media interactions.

Nicolas Cage’s journey to financial rehabilitation has been a long and ongoing process.

While he may never regain the extraordinary wealth he once possessed, his efforts to rebuild his career and stabilize his finances demonstrate resilience and adaptability.

This period of Cage’s career offers valuable lessons in the importance of financial prudence and the possibility of professional reinvention.

As we’ll explore in the next section, Cage’s experience provides insights into wealth management that apply far beyond Hollywood stardom.

Lessons Learned: Wealth Management for High-Earners

Nicolas Cage’s financial saga offers many lessons for high-earners across all industries.

His journey from the pinnacle of Hollywood success to the brink of bankruptcy and subsequent efforts to rebuild provides valuable insights into the pitfalls of sudden wealth and the importance of sound financial management.

1. The Importance of Diversification

Cage’s heavy investment in real estate highlights a crucial lesson:

- Don’t put all eggs in one basket: Diversifying investments across different asset classes can help mitigate risk.

- Liquidity matters: Maintaining a balance between liquid and illiquid assets is crucial for financial flexibility.

- Market awareness: Understanding market cycles and not overexposing oneself to a single sector is vital.

2. Living Within Means

Even for high-earners, sustainable spending is key:

- Lifestyle inflation: Avoid letting spending habits grow unchecked as income increases.

- Future planning: Consider the sustainability of current spending in the face of potential income fluctuations.

- Emergency funds: Maintain liquid savings to cover unexpected expenses or income drops.

3. The Value of Financial Literacy

Cage’s situation underscores the need for personal financial understanding:

- Education is key: High earners should invest time in understanding basic financial principles.

- Question advice: Don’t blindly trust financial advisors; maintain an active role in financial decision-making.

- Continuous learning: Stay informed about tax laws, investment options, and financial best practices.

4. Tax Compliance is Non-Negotiable

Cage’s tax troubles serve as a stark reminder:

- Stay current: Prioritize tax payments and maintain meticulous records.

- Seek expert help: Employ qualified tax professionals to navigate complex tax situations.

- Plan ahead: Anticipate tax liabilities, especially for those with irregular income streams.

5. The Risks of Impulse Purchases

Cage’s eclectic collection of high-value items offers a cautionary tale:

- Emotional vs. rational spending: Distinguish between purchases that bring joy and those that are sound investments.

- Consider long-term costs: Factor in maintenance, insurance, and potential depreciation of luxury items.

- Collecting vs. investing: Recognize the difference between building a collection and making financial investments.

6. The Importance of Professional Advice

Proper financial guidance is crucial:

- Vet advisors thoroughly: Choose financial advisors with proven track records and proper credentials.

- Team approach: Consider employing a team of specialists (financial advisor, accountant, lawyer) for comprehensive management.

- Regular reviews: Conduct periodic reviews of financial strategies and advisor performance.

7. Career Management as Financial Management

Cage’s career choices post-financial crisis offer insights:

- Diversify income streams: Look for ways to expand and vary sources of income.

- Brand management: Recognize how personal and professional reputation can impact earning potential.

- Long-term thinking: Make career decisions with short-term and long-term financial implications.

8. The Psychology of Wealth

Understanding one’s relationship with money is crucial:

- Self-awareness: Recognize personal triggers for overspending or risky financial behavior.

- Seek balance: Find a middle ground between enjoying wealth and preserving it.

- Values alignment: Ensure spending and investment choices align with personal values and long-term goals.

Nicolas Cage’s financial journey serves as a powerful reminder that no amount of wealth is immune to mismanagement.

For high-earners in any field, the lessons drawn from Cage’s experience underscore the critical importance of financial literacy, prudent planning, and disciplined wealth management.

By understanding and applying these lessons, individuals can work towards building and maintaining financial stability, regardless of their income level.

While extreme, Cage’s story offers valuable insights that can help others navigate the complex world of wealth management and avoid similar pitfalls.

Conclusion

The saga of Nicolas Cage’s financial rise and fall is a compelling cautionary tale, rich with lessons for Hollywood elites and everyday individuals alike.

From the dizzying heights of Hollywood stardom to the depths of financial ruin, Cage’s journey illustrates the volatile nature of fame and fortune in the entertainment industry.

At his peak, Cage embodied the Hollywood dream – commanding multimillion-dollar paychecks, amassing a property empire that spanned the globe, and indulging in extravagances that seemed befitting his larger-than-life screen persona.

However, this tale of excess took a dramatic turn when a perfect storm of factors – including reckless spending, ill-timed real estate investments, and significant tax issues – converged to bring Cage’s financial house of cards tumbling down.

By taking on more diverse roles, downsizing his lifestyle, and approaching his finances with newfound caution, Cage has shown that rehabilitation is possible even in the face of severe setbacks.